ความเร็วและความปลอดภัยคือทุกอย่างเมื่อพูดถึงการทำธุรกรรมเงินสดที่คาสิโนในท้ายที่สุด นั่นเป็นส่วนสำคัญในการสร้างประสบการณ์ที่ดีของลูกค้าประสิทธิภาพในการดำเนินงานนั้นรู้สึกได้โดยเฉพาะในช่วงเวลาสูงสุดเมื่อคาสิโนเห็นการจราจรบนเท้าที่สูงขึ้นการโจรกรรมและการโกงเป็นภัยคุกคามด้านความปลอดภัยอย่างสม่ำเสมอ โดยการมุ่งเน้นไปที่ขั้นตอนการจัดการเงินสด ระบบเฝ้าระวังและเทคโนโลยีอื่นๆเพื่อตรวจค้นและป้องกันกิจกรรมการฉ้อฉลเป็นสิ่งสำคัญอย่างยิ่งสำหรับธุรกิจ

แน่นอนว่าความไว้วางใจและชื่อเสียงของคาสิโนขึ้นกับความเร็วและความปลอดภัยของธุรกรรมเหล่านี้นอกเหนือจากนี้แน่นอนว่าคาสิโนอยู่ภายใต้การปฏิบัติตามกฎเกณฑ์ในพื้นที่นี้

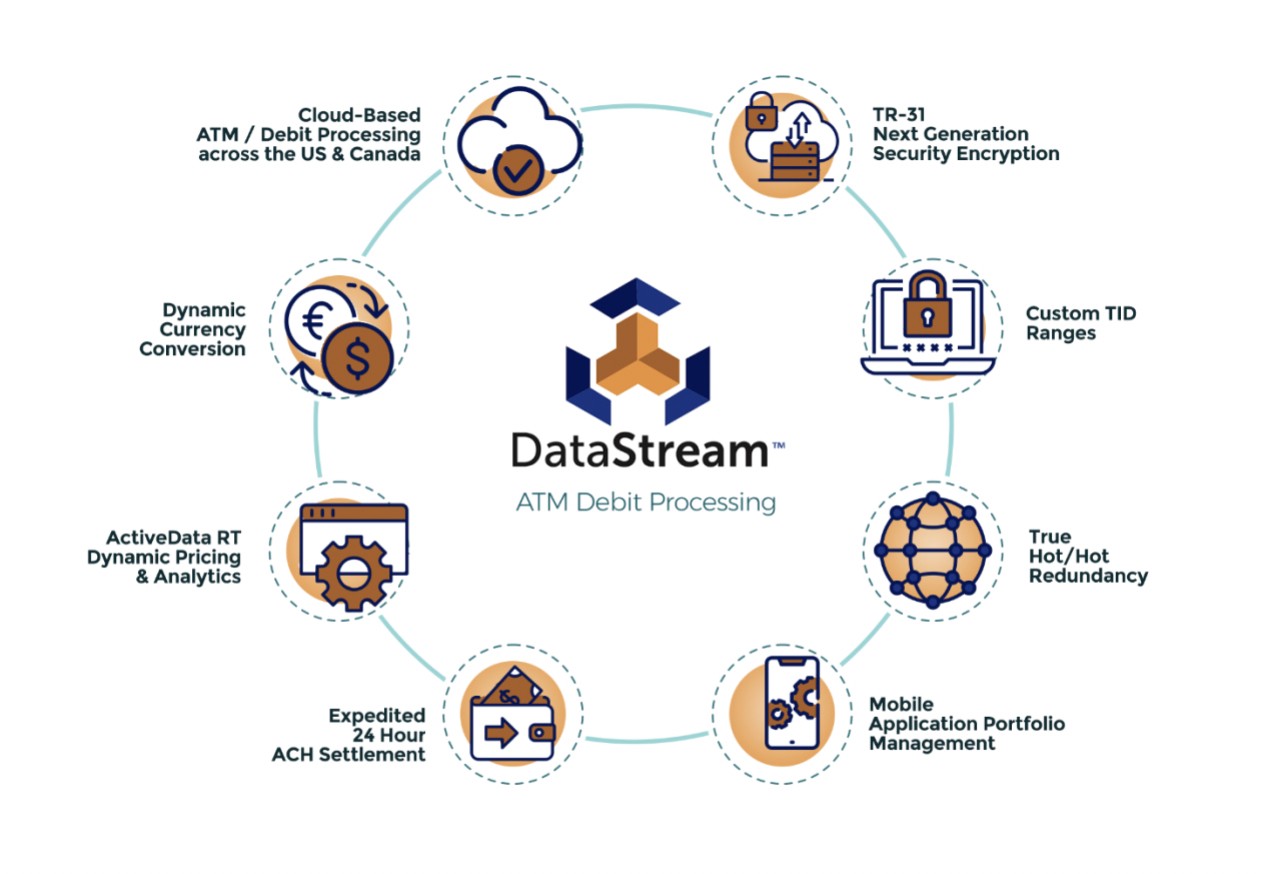

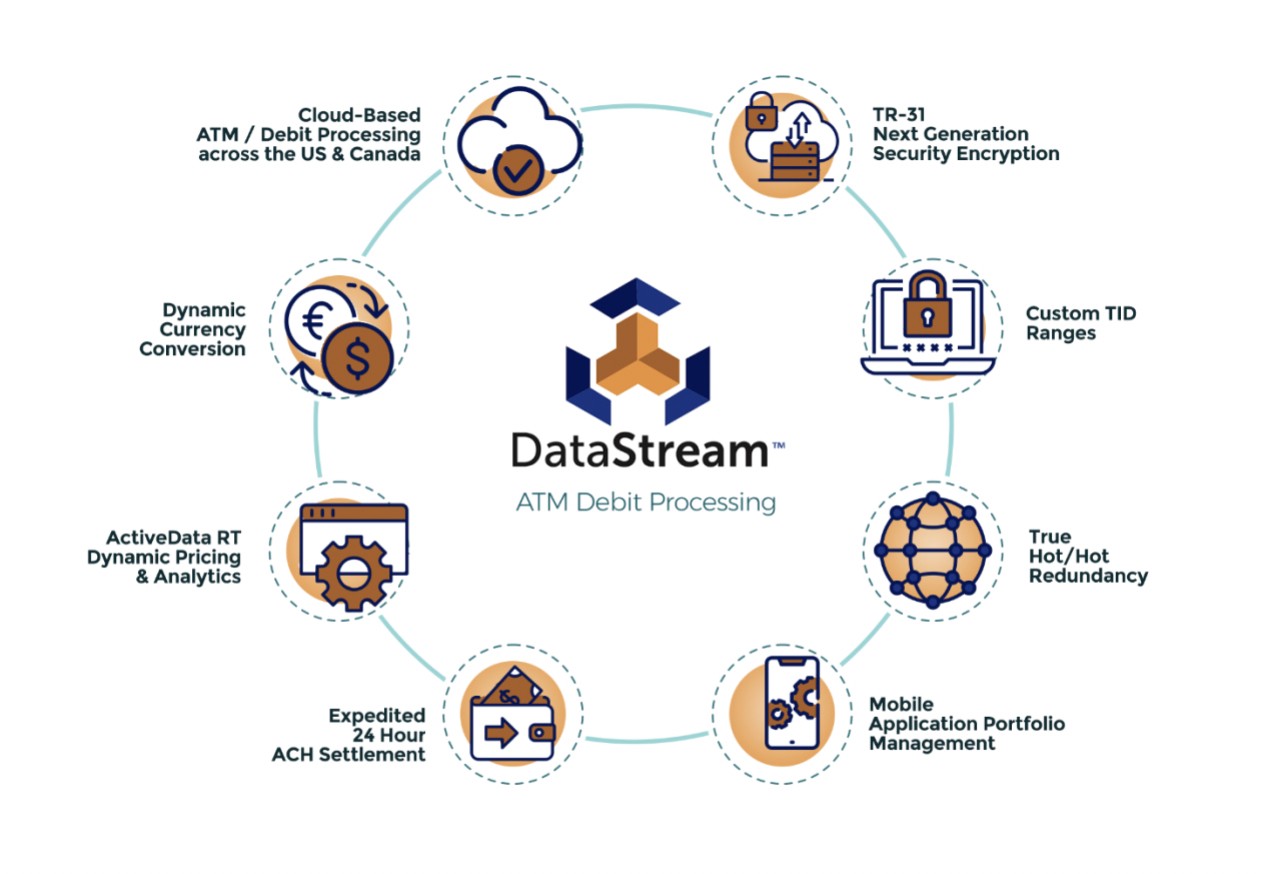

ผู้คนที่ Passport Technology Inc. ผู้ให้บริการเทคโนโลยีการชำระเงินที่เติบโตอย่างรวดเร็วทันใจให้กับอุตสาหกรรมเกมระดับโลกรู้ทั้งหมดนี้DataStream ซึ่งเป็นโซลูชันการจัดการและเข้าถึงเอทีเอ็มที่เป็นกรรมสิทธิ์ของ Passport ขณะนี้เปิดให้บริการที่คาสิโนทั่วสหรัฐอเมริกาและแคนาดาโดยมีการขยายไปยังสหราชอาณาจักร

DataStream เปิดตัวในปี 2003 ในสหรัฐอเมริกา (พวกเขาเริ่มให้บริการประมวลผลให้กับคาสิโนในปี 2008) ได้กลายเป็นหนึ่งในโปรเซสเซอร์ ATM ที่เป็นกรรมสิทธิ์ที่เติบโตเร็วที่สุดและได้รับการสนับสนุนจากธนาคาร ซึ่งอำนวยความสะดวกในการประมวลผลธุรกรรม ATM, POS และ Value-Add ให้กับลูกค้าค้าปลีกและการเล่นเกม

ในปี 2020 DataStream ได้เป็นผู้ก่อกำเนิดสถลาปัตยกรรมการประมวลผลบนคลาวด์ที่เป็นนวัตกรรมใหม่และเต็มรูปแบบเพื่อให้ลูกค้าประมวลผลมีความน่าไว้ใจระดับที่ไม่มีใครเทียบได้ การเพิ่มจำนวนเงินอัตโนมัติ เวลาทำงาน และความปลอดภัยในการประมวลผลที่ไม่สามารถใช้ได้ในสภาพแวดล้อมที่โฮสต์แบบดั้งเดิม

CDC Gaming Reports ได้เจอกับ John Steely ประธานเจ้าหน้าที่ลูกค้าและประธานเจ้าหน้าที่สารสนเทศ และ Kent Cain รองประธานอาวุโส ฝ่ายปฏิบัติการแพลตฟอร์ม เกี่ยวกับจุดเริ่มแรกของ DataStream และว่าเทคโนโลยีของบริษัทมีความเหมาะสมและปรับตัวได้อย่างสมบูรณ์ในอุตสาหกรรมเกมที่กำลังเติบโตและพัฒนาอย่างเร็ว

ตามข้อมูลของ American Gaming Association มีคาสิโน 1,011 แห่งในสหรัฐอเมริกาโดยมีผลกระทบทางเศรษฐกิจ 328.6 พันล้านดอลลาร์

โปรเซสเซอร์ ATM คือสิ่งที่เชื่อมต่อคุณกับธนาคารของคุณตู้เอทีเอ็มส่วนมากเป็นของสถาบันการเงิน

“มีโปรเซสเซอร์อิสระสองสามตัว” Steely กล่าว“พวกเราก็มีของตัวเองสิ่งที่พิเศษเกี่ยวกับพวกเราคือเราสร้างสวิตช์การประมวลผลของพวกเราเองซึ่งพวกเราใช้เพื่ออำนวยความสะดวกในการทำธุรกรรมของพวกเราเอง”

เป็นเครื่องเอทีเอ็มทางกายภาพดังเช่นเดียวกับซุ้มมัลติฟังก์ชั่นระบบกรงระบบแบ็คออฟฟิศ ทั้งหมดเชื่อมต่อเพื่อดำเนินการประมวลผลและส่งธุรกรรมผ่านสวิตช์

“สถาปัตยกรรมภายในของพวกเราสำหรับสวิตช์นั้นเชื่อมต่ออัปสตรีมเพื่อให้ธุรกรรมเหล่านั้นไปยังโครงข่ายและอำนวยความสะดวกในการทำธุรกรรมพวกนั้นกลับสู่สภาพแวดล้อมการเล่นเกมได้อย่างรวดเร็ว เพื่อให้แขกสามารถเข้าถึงเงินสดได้” Cain กล่าวเสริม

นั่นคือข้อได้เปรียบที่ Passport Technology Inc. และ DataStream มี: เป็นสวิตช์และสโผลงปัตยกรรมที่ผลิตขึ้นเพื่ออำนวยความสะดวกในการทำธุรกรรมการเข้าถึงเงินสดเฉพาะที่ไม่เหมือนใครในสภาพแวดล้อมการเล่นเกม

“ประการแรกคือพวกเราต้องรักษาความปลอดภัยการทำธุรกรรมด้วยวิธีที่ไม่เหมือนใคร” เคนกล่าว“โดยเหตุนี้จากตำแหน่งการจัดการการปฏิบัติตามกฎเกณฑ์และการโกง พวกเรามีคุณสมบัติพิเศษภายในสวิตช์ของพวกเราซึ่งจะช่วยปกป้องสภาพแวดล้อมการเล่นเกมในระดับที่ลึกกว่าการประมวลผลตู้เอทีเอ็มปลีกทั่วๆไป

“ประการที่สองจะเป็นความซ้ำซ้อนด้วยเหตุนั้นสภาพแวดล้อมการเล่นเกมจึงเจริญเติบโตได้ในเวลาใช้งาน 100 เปอร์เซ็นต์เป็นสิ่งสำคัญจากระดับสวิตช์ที่ระบบการเข้าถึงเงินสดยังคงใช้งานได้และพร้อมใช้งานกับคาสิโนในร้อยละ 100 ของเวลาดังนั้นจึงเป็นเรื่องของการสร้างความล้มเหลวอัตโนมัติพวกนี้ซึ่งไม่มีอยู่ในสวิตช์อื่นๆแต่ให้บริการสภาพแวดล้อมการเล่นเกมโดยเฉพาะอย่างยิ่ง”

สำหรับลูกค้าคาสิโนของพวกเขา “ถาม” ที่ใหญ่ที่สุดคือ “คุณจะพร้อมสำหรับฉันหรือไม่?”มันเป็นเวลาเปิดใช้งาน คุณมีอะไรบ้าง คุณให้คาสิโนเข้าถึงเงินสดได้ตลอดเวลาได้อย่างไรตลอดเวลาและ DataStream จะก่อให้การทำธุรกรรมเงินสดของคาสิโนดูแตกต่างและดีมากกว่าธุรกรรมเงินสดของคาสิโนอื่นๆได้อย่างไร

“นั่นเป็นหนึ่งในข้อได้เทียบที่ยิ่งใหญ่ที่สุดของ DataStream ในวันนี้” Cain กล่าวเสริม“DataStream และ Passport Technology ซึ่งเป็นผู้สร้างซุ้มและซอฟต์แวร์ที่อำนวยความสะดวกในการทำธุรกรรม ทำงานร่วมกันอย่างราบรื่นเพื่อสร้างโฟลว์จากประเภทธุรกรรมที่ปรับแต่งตัวแปรบนพื้นจนถึงเครือข่ายการประมวลผลและการอนุญาตและกลับไปยังเทอร์มินัลเอง

“นั่นทำให้เรามีความสามารถที่ไม่เหมือนใครในการปรับแต่งฟังก์ชันและการทำธุรกรรมและสร้างธุรกรรมประเภทใหม่และการทำธุรกรรมที่ทำหน้าที่เป็นแขกและลูกค้าและยังสามารถสร้างรายได้เพิ่มเติมให้กับคาสิโน”

ในทางกลับกัน หากคาสิโนขนาดกลางที่ทำงานกับโปรเซสเซอร์ขนาดใหญ่ต้องการเปลี่ยนขั้นตอนการทำธุรกรรมด้วยการถอนเงินตัวอย่างดังเช่นหรือเพื่อให้รายงานดูเป็นทางใดทางหนึ่ง Passport สามารถทำการเปลี่ยนแปลงนั้นให้เขาได้เพราะฉะนั้นการเปลี่ยนแปลงการปรับตัวในการดำเนินงานระหว่างการวิ่งสำหรับคาสิโนที่เกี่ยวข้องกับการขยายจำนวนการจราจรบนเท้าจึงเป็นสิ่งสำคัญด้วยคาสิโนขนาดกลางที่ทำงานกับหนึ่งในโปรเซสเซอร์ขนาดใหญ่พวกเขาจะไม่เปลี่ยนกระแสของคาสิโนนั้นด้วยเหตุว่ามันไม่สมเหตุสมผลทางเศรษฐกิจสำหรับพวกเขา

“พวกเขามีธุรกรรมหลายแสนคนถ้าเกิดไม่ใช่หลายล้านรายการและพวกเขาจะไม่ทำการเปลี่ยนแปลงกระแสสำหรับคาสิโนขนาดกลาง” Steely กล่าว“มันเป็นการพัฒนามากเกินไป เวลามากเกินไปมันไม่คุ้มค่าสำหรับพวกเขาแต่ส่วนตัวเราเพราะว่านั่นคือลูกค้าของเรามันคุ้มค่าส่วนตัวสำหรับเราด้วยเหตุดังกล่าวพวกเราจะทำการเปลี่ยนแปลงนั้นให้พวกเขาเราทำสิ่งนี้ตลอดเวลา”

การมีความคล่องตัวและสามารถปรับแต่งได้ทันที นั่นคือความแตกต่าง – ผู้สร้างในอุตสาหกรรมที่แข่งขันได้ Steely กล่าวเสริม

“ลูกค้าของพวกเราเกือบทุกคนขอสิ่งที่ไม่เหมือนใครและเราจัดส่งทุกหน” เขากล่าว

ข้อดีอย่างหนึ่งที่พวกเขามีคือรอยเท้าเทคโนโลยีทั้งหมด ด้วยเหตุนี้แอปพลิเคชันทั้งหมด การประมวลผลและสภาพแวดล้อมโครงข่ายทั้งหมด จึงอยู่ในสโผลงปัตยกรรมบนคลาวด์นั่นเป็นเรื่องหายาก

“มันพูดถึงความซ้ำซ้อนอีกทีที่คลาวด์เองมีระบบรักษาความปลอดภัยในตัวขนาดใหญ่และระบบตรวจสอบการคดโกง” Cain กล่าว“แต่ในเวลาเดียวกัน มันยังล้มเหลวโดยอัตโนมัติในหลายวิธีที่สภาพแวดล้อมภาคพื้นดินไม่ทำเหมือนกัน พูดถึงเวลาทำงานสำหรับผู้ให้บริการอีกครั้ง”

คำถามเกี่ยวกับความปลอดภัยกำลังพัฒนาขึ้น เมื่อหลายปีที่ผ่านมาคาสิโนถามคำถามว่าผู้ให้บริการจะรักษาความปลอดภัยข้อมูลของผู้ถือบัตรหรือไม่ ด้วยเหตุนี้จึงไม่ได้นำมาจากสภาพแวดล้อมของคาสิโน ไปจนถึงสิ่งที่พวกเขาถามเพิ่มเติมในทุกวันนี้ — ผู้ให้บริการ เอทีเอ็ม ปฏิบัติตามขอบเขตของ PCI (อุตสาหกรรมบัตรชำระเงิน) หรือไม่ ตั้งแต่พื้นไปจนถึงการสลับไปยังโครงข่ายผู้ประกอบการคาสิโนทราบว่านั่นคืออะไรและความลึกของมันและทราบว่ามันหมายถึงความปลอดภัยของข้อมูลแขกของพวกเขา

การเติบโตของ บริษัท?Passport Technology Inc. มุ่งเน้นไปที่สหรัฐอเมริกาแคนาดาและสหราชอาณาจะรอย่างเท่าเทียมกัน ปรับปรุงแก้ไขและพัฒนาอย่างรวดเร็วทันใจเพื่อตอบตอบสนองภูมิทัศน์คาสิโนที่เปลี่ยนแปลง

“จากมุมมองด้านเทคโนโลยีฉันสามารถสร้างเทคโนโลยีนี้ได้หลากหลายเท่าใด”เคนกล่าว“ฉันจะทำสิ่งนี้ได้อย่างไร เพื่อให้เราเปลี่ยนแปลงอย่างสม่ำเสมอเพื่อตอบตอบสนองภูมิทัศน์ที่เปลี่ยนแปลงไปกับธุรกรรมและเทคโนโลยี?สิ่งที่เราต้องทำคือสร้างสโผลงปัตยกรรมแบบแยกส่วนเพื่อให้เราสามารถอัปเดตและเสียบจุดใหม่ได้อย่างสม่ำเสมอ

“การปฏิบัติตามระเบียบมีการเปลี่ยนแปลงอย่างรวดเร็วทันใจและถ้าหากคุณเป็นสวิตช์ที่ติดอยู่ในสิ่งที่พวกเขาเรียกว่าสถาปัตยกรรมสแต็คหรือหากแม้แต่สถลาปัตยกรรมสแต็คภาคพื้นดิน คุณจะไม่สามารถใช้การเปลี่ยนแปลงใหม่ที่จำเป็นจะต้องเพื่อให้สอดคล้องกับความสอดคล้องได้

“สิ่งเดียวกันสามารถบอกได้สำหรับชุดธุรกรรมใหม่ ไม่ว่าจะเป็นกระเป๋าเงินตามจุดสูงขึ้นตามความภักดี ผลิตภัณฑ์ทั้งหมดเหล่านั้นต้องเสียบในลักษณะที่สามารถใช้งานได้ง่ายและเร็วทันใจด้วยเหตุนั้นการสร้างสโผลงปัตยกรรมที่เหมาะสมเพื่อให้สิ่งต่างๆสามารถย้ายปรับเปลี่ยนและอัปเดตได้โดยไม่ต้องสร้างมรดกที่ช้าในการเพิ่มขึ้นตามความต้องการด้านเทคโนโลยีของธุรกรรมกลุ่มนี้เป็นสิ่งสำคัญอย่างยิ่ง”